Deposits made at night or over a weekend or holiday must be treated as if received on the next business day following the deposit. Multiple currency transactions resulting in either cash in or cash out totaling more than $10,000 during any one business day must be treated as a single transaction, if the bank has knowledge that they are conducted by or on behalf of any person.

and, therefore, branch office transactions must be aggregated. Aggregation of Currency Transactionsįor the purposes of currency reporting requirements, a bank includes all of its domestic branch offices 5.

The mere notation of “known customer” or “bank signature card on file” on the report is prohibited.

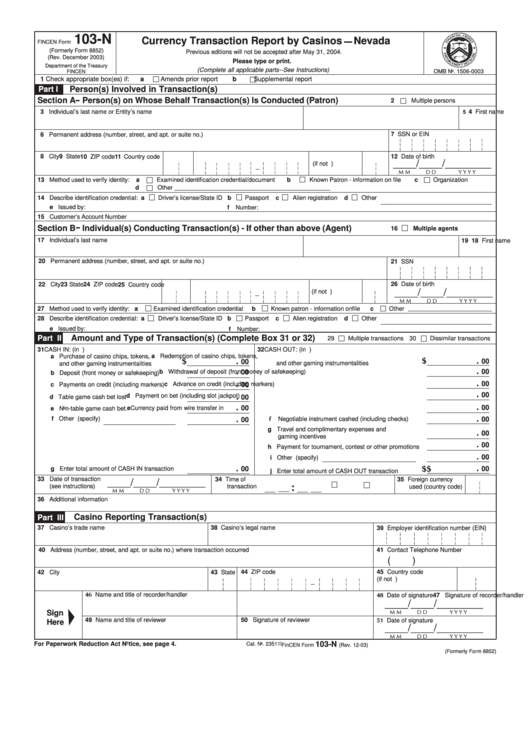

#CURRENCY TRANSACTION REPORT FORMS LICENSE#

, the driver’s license number) used in verifying the identity of the customer must be recorded on the report. In each instance, the specific identifying information (e.g. A bank signature card may be relied upon only if it was issued after documents establishing the identity of the individual were examined and notation of the specific information was made on the signature card.

#CURRENCY TRANSACTION REPORT FORMS VERIFICATION#

Verification of identity in any other case must be made through a document, other than a bank signature card, that is normally acceptable as a means of identification when cashing checks for nondepositors (e.g., a driver’s license or credit card). Verification of the identity of an individual who indicates that he or she is an alien or is not a resident of the United States must be made by passport, alien identification card, or other official document evidencing nationality or residence (e.g., a provincial driver’s license with indication of home address). Identification RequiredĪ bank must verify and record the name and address of the individual presenting a transaction, as well as record the identity, account number, and Social Security or taxpayer identification number, if any, of any person or entity on whose behalf such a transaction is conducted. Refer to the Transactions of Exempt Persons section for more information. These currency transactions need not be reported if they involve “exempt persons,” a group which can include commercial customers meeting specific criteria for exemption. (deposit, withdrawal, exchange of currency, or other payment or transfer) of more than $10,000 by, through, or to the bank. Forms to be used in making reports of currency transactions may be obtained from BSA E-Filing System (. Effective July 1, 2012, FinCEN mandated electronic filing of certain BSA reports, including the CTR. 100(m) defines currency as coin and paper money of the United States or any other country that is designated as legal tender and that circulates and is customarily used and accepted as a medium of exchange in the country of issuance. Specifically, this section covers:Ī bank must electronically file a Currency Transaction Report (CTR) for each transaction in currency 1. This section outlines the regulatory requirements for banks found in 31 CFR Chapter X regarding reports of transactions in currency. Regulatory Requirements for Currency Transaction Reporting Objective: Assess the bank’s compliance with the BSA regulatory requirements for currency transaction reporting.

0 kommentar(er)

0 kommentar(er)